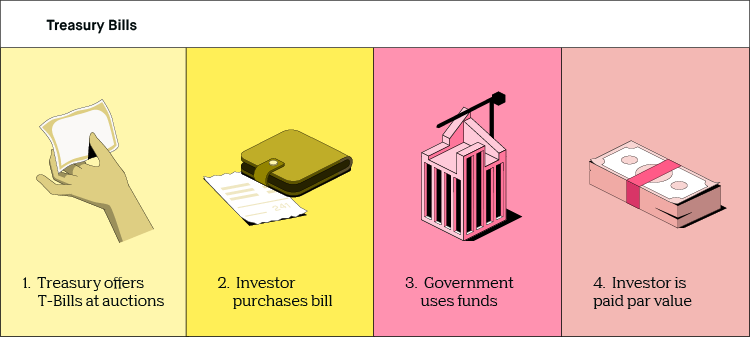

What’s a treasury invoice and the way does it paintings? – Ever questioned how governments carry cash with out going to the financial institution? Treasury expenses are a the most important device of their monetary toolbox. Call to mind them as non permanent loans issued through the federal government to fund its actions. As an alternative of borrowing from banks, the federal government borrows immediately from people and establishments. It is a easy, but robust, method to finance tasks and stay the economic system ticking over.

The way it Works: Consider you lend cash to the federal government for a brief length, say 4 weeks, 8 weeks, or 13 weeks. In go back, the federal government guarantees to pay you again the fundamental quantity plus a small charge (hobby) on the finish of the mortgage time period. It is like an excessively non permanent financial savings account, however as a substitute of incomes hobby to your cash, you earn hobby to your mortgage. The federal government acts because the borrower and you’re the lender.

Why are Treasury Expenses Necessary? Those expenses are an crucial a part of a rustic’s monetary gadget. They provide a secure, liquid, and simply available method for people and establishments to speculate their cash for a brief time period. This non permanent borrowing is helping the federal government arrange its money float, fund crucial tasks, and deal with a strong economic system. By means of providing quite a lot of adulthood dates, the federal government caters to other funding wishes.

Key Options of Treasury Expenses:

- Low Possibility: Treasury expenses are most often thought to be very low-risk investments as a result of they’re subsidized through the entire religion and credit score of the federal government.

- Liquidity: Treasury expenses will also be simply purchased and bought within the secondary marketplace, making them extremely liquid.

- Number of Maturities: Other maturities are to be had, permitting buyers to select the funding time period that most nearly fits their wishes.

- Easy Construction: The construction of treasury expenses is moderately easy in comparison to different monetary tools, making them simple to know and use.

Instance: Let’s assume you put money into a 13-week Treasury invoice at a reduced price of 98.00. This implies you pay $980 for a $1,000 face price. On the finish of 13 weeks, the federal government will pay you again the entire $1,000. The adaptation between the face price and the cost you paid is the hobby you earn.

Who Makes use of Treasury Expenses?

- Person Buyers: Folks in search of a secure and liquid non permanent funding possibility.

- Banks: Used to control their non permanent money wishes.

- Firms: Can use them as a part of their total funding technique.

In Abstract: Treasury expenses are an easy and protected method for governments to borrow cash and for buyers to earn a go back on their investments. Their low threat, liquidity, and various adulthood choices cause them to a treasured device within the monetary markets. Working out how they paintings will let you make knowledgeable funding selections.

Well-known Entity Comparable: The U.S. Treasury Division performs a central function in issuing and managing Treasury expenses. Understanding the function of the U.S. Treasury can additional enrich your figuring out of treasury expenses.